About Ziwox Terminal Modules

What is Ziwox Terminal?

Ziwox Terminal is an intelligent trading aid that helps financial markets traders reach smart decisions informed by the latest market trends, sentiments, economic news, and forecasts.

Ziwox Terminal functions as a terminal consisting of different synergistic components. Each component individually acts as a trading aid indicator or explanatory market report that helps inform decision making. Each component provides an outlook but together, the synergy of all components makes an integrated decision-aid system output that helps traders improve the quality of their ultimate buy, sell, or wait decisions, and thus improve their trading results.

Institutions, hedge funds, and banks hold large amount of market liquidity and they can drive the market and establish trend. They are the most common holders of the market liquidity and know the retail traders' positions and liquidity map. They can drive the market to retrace with a big correction such that most of retail traders stop hit. Sometimes the market price correction creates a fake trend reversal when the retail traders take a position against the main trend. Staying in the direction of the trend is the key to success and Ziwox Terminal would be the best assistance to trade according the market direction.

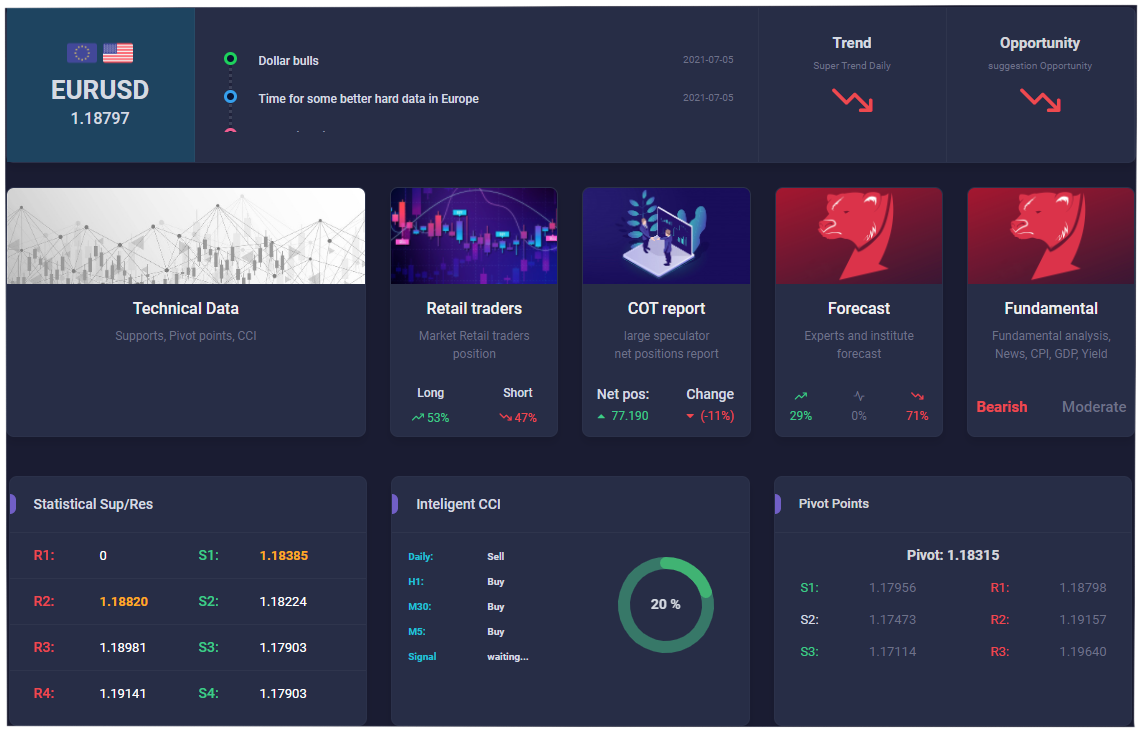

The outcome of all components in the Ziwox Terminal is an ultimate outlook of the market which is presented in Opportunity Suggestion. This suggestion carries an opportunity that comes through ready-to-use analysis of each terminal’s component in forms of trend direction, forecast, COT reports, market sentiments, technical outlook, and fundamental outlook. Terminal’s components are such as technical indicators, fundamental indicators, economic calendar, retails traders’ trade dynamic, and non-commercial (speculators) traders’ trade dynamic in CFTC’s COT reports. As a trading support, a technical indicator is also used to show the precise support and resistance levels with break out probabilities of each level through statistical volatility analysis.

Proper utilization of the Ziwox Terminal increases accuracy of market entry and exit that leads to profitable investments.

How to use Ziwox Terminal to fortify quality and performance of your trades?

Application and utilization of the Ziwox Terminal are simple and straightforward. It is designed with a high level of transparency and utilization by keeping all confusing market information in the background. Instead of confusing information, the Ziwox Terminal provides an impressing straightforward decision-aid outlook of the market to traders which is a distinct Buy, Sell, or Wait suggestion. Traders just need to refer to Opportunity Suggestion and use their strategy to enter the market according to it’s suggestion. Retail traders receive lots of daily data and information such as daily economic news, market events, indicators’ data, and technical analysis. Making a trading decision using all the mentioned data is more confusing rather than being a facilitator. Get surrounded by a massive amount of information in the financial markets make traders overwhelmed and confused. Traders get confused when published daily technical and fundamental analyses supported by that information combine both buy and sell scenarios together. Analysts and advisors of the financial market conservatively tend to avoid transparency by covering both buy and sell trades scenarios in their analysts.

This terminal uses diverse components and each of them does a lot of jobs in the background but in the foreground provides a transparent easy to understand result and market direction. Despite the market complication and complexity, many of these components just show bios, sentiments, or trend direction.

About Ziwox Terminal modules

Fundamental data

Our professional analysis team, all days, collecting Economic data, news, events, country yields, CPI, NFP data, Political points and all financial factors from our watchlist pairs to set the pair fundamental bias. This is the overview of fundamental analysis for currency pairs based on news, events, and currency economy outlook.

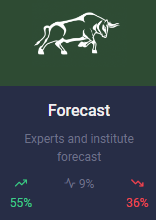

Experts Forecast

This is a voting forecast report that comes from expert traders and financial institutions' trading teams. It presents next week's market forecast. It shows how much in the percentage the expert traders forecast bullish and how much in the percentage they forecast bearish for next week.

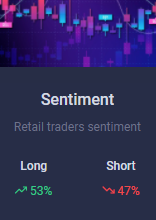

Retail traders

Retail traders' sentiment shows retail traders' long and short positions. It can be used as a sentiment to determine positioning across a range of assets. Essentially, it shows where most traders' positions are set and what percentage of traders hold buy or sell positions. This sentiment is a contrarian indicator because statistical analysis shows that most retail traders are trend fighters and take positions against the market trend. The trend momentum will benefit too when the traders that are against the trend exit from the market. Strong up-trend momentum combined with extreme net-short retail traders positioning, results in a buy signal. And vice versa, the strong down-trend momentum combined with extreme net-long retail traders positioning, results in a sell signal.

COT reports

The Commitment of Traders (COT) report is a weekly publication of net positions in the future market that is released on Fridays. It is an outline for the commitment of the classified traders as commercial traders, speculators (non-commercial traders), and non-reportable traders. We use this report to understand the dynamics of the market. The commitment of commercial traders is not important for us because they take a position to hedge the value of their assets against market risks due to unfavorable price movements.

So, the commercial traders trade to reduce the risk, not to make a profit. Unlike commercial traders, non-commercial traders trade to make a profit. They are large speculators who make money by investing in the future market. Non-commercial traders include hedge funds, trading advisors, and financial institutions buy in up-trend and sell in down-trend. Any significant change in net short or long positions of non-commercial traders will result in a trend reversal or strong momentum.

We have summarized this report to only show the non-commercial net positions and percentage of the changes from last week. A positive value means net long, and a negative value means net short positions.

Technical data

This is the data generated by technical indicators. We provide three different types of data here. A classical support/resistance using the pivot point, a next-generation support/resistance indicator which is based on statistical volatility range study to determine the levels and their probability. Statistical support/resistance indicator is a proven more precise support/resistance levels calculator. The third indicator data is Intelligent Cci, a superior momentum oscillator that calculates areas of sale, buy, over-sold, and over-bought in the market based on statistical market volatility study. The Intelligent Cci also provides buy or sell trade signals.

Risk Sentiment

Risk sentiment is an indicator that is used to describe how financial market traders feeling about Risk.

Traders When informed about the political issues between some countries, military stimulus, or some global Challenges like coronavirus crisis, They feeling risk on the market and start buying safe-haven assets. like JPY, CHF, USD. We call this situation "RISK-OFF" market.

On other hand is that, market traders feeling good for buying risky assets, like NZD,AUD,CAD or stocks markets too. We call this situation "RISK-ON" market.

We use this indicator to select our watchlist pairs, or evenn care about which pair we buy or sell.

In RISK-OFF sentiment, traders selling risky assets for buying safe-haven assets to reduce their basket risk.

In RISK-ON sentiment, traders selling their safe-haven pairs FOR buying risky assets to have more profit gain.

Economic Calendar

Ziwox’s Forex economic calendar is a fully customize-able economic news calendar that users can use to summarize or highlight the targeted news. Certain types of events have been known to impact trade in significant, predictable ways, the nature and date of each event on an economic calendar can be used as a trading indicator to maximize profit potential. Users can customize the view of calendar for any kind of high, medium, and low impact news or economic events.

Opportunity

Based on all components’ data and sentiment, the terminal gives an overall outlook for next week of market. This outlook could be considered as position taking but it does not mean that it will profitable. All traders should take positions based on their strategy and apply proper risk management; Ziwox does not accept any responsibility for traders’ loss.